The RSIC works diligently to maintain its position as an industry leader in investment fee transparency. We remain committed to executing best practices that control and reduce management fees through portfolio diversification, fee negotiations, and selective use of asset management. This includes obtaining fee concessions on new and existing investments and limiting active management within inefficient asset classes.

Because public pension plan investment management fee reporting requirements vary based on their respective jurisdictional regulation, comparing one plan's fees to another’s may not be an apples to apples comparison. In short, not all states disclose the same fees. Consistently, the RSIC has gone to great lengths to report invoiced management fees, management fees netted against investments, performance fees (both accrued and paid), and other expenses including administrative costs in limited partnership structures.

We believe in transparency and upholding our fiduciary responsibility to manage the assets held in trust for our plan participants and beneficiaries. This includes benchmarking our annual cost and return performance to Cost Effectiveness Measurement Inc.’s (CEM) extensive pension database. In making fiduciary decisions, we are partners with and advocates for our members, and we believe in helping them understand what they are paying for. Current and past CEM reports can be found here.

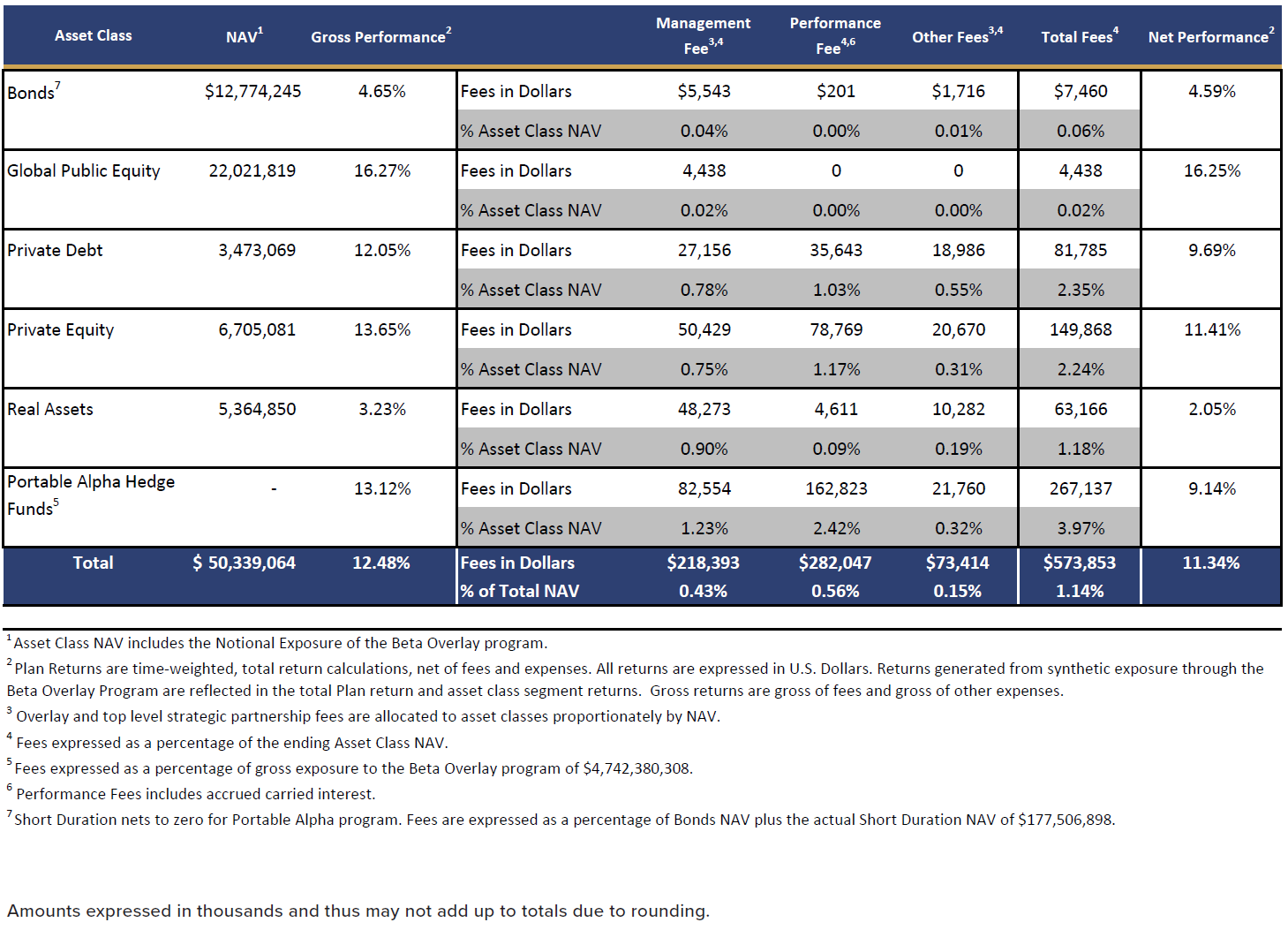

RSIC’s investment costs, performance information, as well as the chart below can be located in the Annual Investment Report.

Investment Management Fees and Expenses by Asset Class for FY 2025