Purpose & Duties

The Retirement System Investment Commission (RSIC) has exclusive authority for investing and managing all assets held in trust for the participants and beneficiaries of the five state defined benefit plans, collectively referred to as the (“Retirement System”) or (Systems).

The RSIC has an unwavering commitment to financial security. The long-term nature of the Retirement System reflects the long-term investing horizon strategy. Each of the defined benefit plans provide lifetime retirement annuities, disability benefits, and death benefits to eligible members and their beneficiaries.

Pension Trust Funds

SC Retirement System (SCRS)

618,333 members

SC Police Officers Retirement System (PORS)

76,066 members

Retirement System for Judges & Solicitors of SC (JSRS)

410 members

Retirement System for General Assembly of SC (GARS)

411 members

National Guard Retirement System (SCNG)

19,184 members

*Trust fund dollar values as of September 30, 2025

*Member numbers as of July 1, 2025

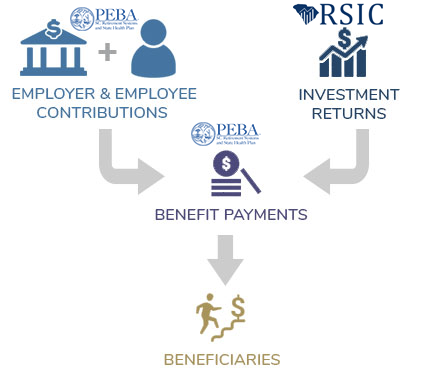

RSIC Pension Fund Structure

Investment income, employer contributions, and employee contributions are the largest sources of revenue to the trust funds.

PEBA administers the state's public pension plan while the RSIC manages the assets of the Retirement System.

Oversight

The statutes governing the RSIC are found in the Title 9, Chapter 16 South Carolina Code of Laws.

While the RSIC has exclusive authority to manage and invest the assets held in trust for the Retirement System's participants and beneficiaries, other fiduciaries and trustees also exercise authority and have oversight roles.

Retirement System Investment Commission (RSIC)

Named Trustee and Fiduciary Responsibilities:

- Invests and manages pension funds

- Selects custodial bank and manages day-to-day custodial banking relationship

Public Employee Benefit Authority (PEBA)

Named Trustee and Fiduciary Responsibilities:

- Sets the RSIC accounting policies

- Custodian of Retirement System assets

- Provides investment accounting and financial reporting

State Fiscal Accountability Authority (SFAA)

Legal Framework:

- Approves the RSIC purchasing policy

- Members appoint 6 of 8 Commissioners

State Legislature

Policy and Legal Framework:

- Sets the RSIC legal authorities

- Sets fund assumed rate of return

- Members appoint 2 of 8 Commissioners

Oversight:

- Approves budget annually

- Approves headcount annually

State Auditor

Oversight:

- Selects fiduciary audit firm

- Conducts fiduciary performance reviews every four years

Attorney General

Oversight:

- Approves retention and rates for non-investment related matters

- Approves hiring of temporary internal counsel

Comptroller General

Oversight:

- Conducts accounts payable and payroll procedures audit

Standards

The pension fund investments are managed by our experienced RSIC (agency) team and the

Commission (governing body). They are supported by hired industry-leading consultants and

external managers. We all work together to make informed, responsible decisions about the

RSIC

investments.

|

WITH SUPPORT FROM:

|

|

||||||||